The pandemic has forced all of us into the disruptive dilemma

What will stay, what will go, when we get out of this maze.

You know how on social platforms, mainly Twitter and LinkedIn, we see the posts of “10 years ago these companies didn’t exist”, emphasizing how much (or in some cases how little) things change? Tweets like this:

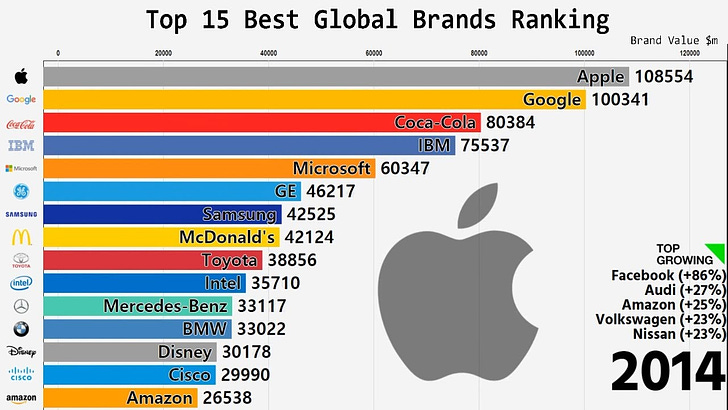

By the way, here’s a good animation of companies jockeying for top brands between 2001 and 2018:

These pandemic-filled days, however, we’re seeing shifts happen at ludicrous speed—from in-person to remote (for everything; schools, work, music), but also our behaviors on everything from shopping to watching television.

The flurry of companies trying to fill the void left behind from not being able to see each other in person has created an interesting environment for innovation. If everyone is trying to “disrupt” the conventional model for their industry, what happens when everyone is forced to disrupt? And then what happens when the world eventually rights itself?

The poster child for 2020, Zoom, for instance, reported its Q3 earnings on Monday:

With the coronavirus pandemic continuing to drive people to Zoom for work, school and family meetings, Zoom’s revenue grew 367% on an annualized basis in the quarter, which ended Oct. 31, according to a statement. In the previous quarter revenue increased 355%, and in the quarter before that, revenue had risen 169%.

Its stock price is up 591 percent since the beginning of the year. And with multiple vaccinations on the way, if we’re having this conversation a year from now, will Zoom still be word of choice for video conferencing?

Related, today, TechCrunch reported that virtual events platform Bizzabo raised a whopping $138 million to help companies transition to the remote world. Again, only in 2020. Even with vaccines, I imagine it will take a long time before a company decides to take on the liability of holding an in-person conference, let along before attendees (at least at scale) will feel comfortable sitting in a ballroom listening to mundane panels.

Events, especially in the B2B publisher world, are a huge revenue driver. But what make them important for the industry is the ability to network. It’s why people (well, their companies, really) spend up to $3,000 for the privilege of going to a fancy resort in Palm Springs or Scottsdale in the middle of an east coast winter.

One media exec recently told me, as they are planning out their 2021 T&E budget, that they aren’t earmarking anything for travel for events for next year; and this is a publisher that also puts on events, which the exec said they aren’t even considering.

In an interview with TechCrunch, Bizzabo CEO Eran Ben-Shusan said:

“Our data shows that although there are meaningful advantages to virtual events (higher reach, lower production costs), event organizers and attendees want to go back to live events,” said Ben-Shushan. “2021 will mark a new era in the event industry – the hybrid era that integrates experiences of remote and live participants.”

We all know our shopping behaviors have changed this year. We have become even more reliant on Amazon, as we can’t/don’t stroll the aisles of our favorite stores (assuming our favorite stores are still standing).

So much so, that the New York Times reported last week that:

Amazon added 427,300 employees between January and October, pushing its work force to more than 1.2 million people globally, up more than 50 percent from a year ago. Its number of workers now approaches the entire population of Dallas.

The spree has accelerated since the onset of the pandemic, which has turbocharged Amazon’s business and made it a winner of the crisis. Starting in July, the company brought on about 350,000 employees, or 2,800 a day. Most have been warehouse workers, but Amazon has also hired software engineers and hardware specialists to power enterprises such as cloud computing, streaming entertainment and devices, which have boomed in the pandemic.

And yesterday, GroupM pushed a report that digital advertising now eats TV advertising’s lunch, and that the pandemic has pushed digital spend towards Amazon, Google and Facebook, as consumers started shopping from our couches and not stores. So advertisers decided to put more money into those digital pipes:

GroupM expects marketers to spend $110.1 billion on digital ads this year, or 51% of the total $214.6 billion total U.S. advertising-spending forecast, excluding political ad outlays. Next year, it expects U.S. ad spending to grow 12% to $240 billion, and digital advertising to account for $130 billion, or 54% of the total.

Today, the Wall Street Journal reports that UPS has “imposed shipping restrictions on some large retailers such as Gap Inc and Nike Inc.this week, an early sign that the pandemic-fueled online shopping season is stretching delivery networks to their limits.”

Other retailers on the restricted list: L.L. Bean, Hot Topic, New Egg, and Macy’s.

The move comes during a holiday season when retailers are increasingly dependent on delivery companies to move online orders as store traffic plummets during the coronavirus pandemic, a dynamic that has shifted power significantly. UPS and rival FedEx Corp. have raised prices and promised to hold merchants to volume agreements.

The temporary limits, which some drivers say they haven’t seen during previous holiday seasons, are a sign that UPS is metering the flow of packages into its network to preserve its performance during one of the busiest shipping weeks of the year. The National Retail Federation estimated that online shopping jumped 44% over a five-day stretch including Black Friday and Cyber Monday.

The pandemic has also forced us to reconsider how, if not what, we watch. This year has been the year of streaming (not unlike the Year of Mobile, which it’s been since 1997), as we have plussed or maxed out. Today, for example, Discovery introduced its streaming platform, called, appropriately, Discovery+.

Adweek has a good piece on how the pandemic has accelerated the cable networks’ position on streaming:

The announcement caps a year in which many of the biggest cable networks, and their parent companies, have made bold moves to expand their brands into the streaming space as consumers continue cutting the cord in ever-increasing numbers. That behavior has only been accelerated by the pandemic, as many of these strategy shifts were in the works prior to March’s shutdown.

So here we are, the last month of a never-ending year. Almost exactly a year ago, I wrote two “cover” stories for Adweek’s 40th anniversary issue; one about the 2000s and one about the 2010s, the latter wrapping up the year and decade:

But this is just an aftershock of a bigger tectonic shift during this decade: a connected environment where technology slices through every aspect of our existence, forcing us to change how we work, how we communicate, how we live.

Even if there were no pandemic, we’d be having this conversation, of how fast technology moves and how we adapt. In 10 years, expect more Tweets about “These companies didn’t exist 10 years ago” though I will be curious to see which companies that have thrived in a remote world can succeed when we ultimately regress back to the mean. Or at the very least get to sit in an office together.

Thank you for allowing me in your inbox, today and every day. If you have tips or thoughts on the newsletter, please email me. I like emails! Or you can follow me on Twitter. If you appreciated this edition, please consider sharing across your social platforms. Thank you for reading!!

David Bowie, “Five Years”

Some interesting links:

For life without cookies:

Verizon Media Unveils 'Cookieless' ID To Replace Third-Party Ones (MediaPost)

For publishers who will eventually be addicted to Bezos:

How Jeff Bezos' Washington Post is taking on Google and Facebook with 'insanely unique' ad technology for publishers (PressGazette)

Amazon in talks to buy Wondery (WSJ)

For music-as-narrative:

Why a 41-Year-Old Record About Fascism Matters Now (The Atlantic)

Ray Davies on 50 Years of ‘Lola’ (NYT)

For really dumb politics (which is saying something!):

Trump threatens to veto NDAA if Section 230 isn’t repealed (Washington Post)

For quirky data stories:

The surprising way covid-19 may be affecting scented candles reviews (Washington Post)