Publishers only receive half of an ad spend

Ad tech. Two little words that cause so much headache, heartache, and according to a report published today by the Incorporated Society of British Advertisers (ISBA) and the Association of Online Publishers (AOP) and PwC, bewilderment. (If not a little anger.)

Tracing the advertising spend supply chain—from 15 brands, eight agencies, five DSPs, six SSPs and 12 publishers—the report found:

“publishers receive 51% of advertiser spend on average; and

“taking other visible costs such as DSP/SSP fees and other technology costs, 15% of advertiser spend – an “unknown delta”, representing around one-third of supply chain costs – could not be attributed.”

The industry, both the buy- and sell-side, has long known of the existence of the ad-tech black hole. Now, with this report, and with this fancy visual, we can put some kind of number behind the old Wannamaker quote: “Half the money I spend on advertising is wasted; the trouble is, I don't know which half.”

Beeswax CEO Ari Paparo jumped into the report on Twitter to highlight some of its findings (this is an excellent thread you should read from one of the smartest folks in the industry):

His point on the currency dilemma, how “virtually all programmatic is transacted” in U.S. dollars is an interesting one, as currencies fluctuate.

“Suppose rates updated 1x/day by a DSP. You’re transacting $1=£1.3. During the day the actual rate decreases to $1=£1.25. Your budget spends £1,000 that day, and you are billed that amount. But the SSP was converting at £1.25. So the publisher receives £961.”

Talking to the Financial Times, Jon Mew of the IAB, said programmatic advertising was “complex and relies on many companies to play a part. However, it is not a dark art and we shouldn’t lose sight of the crucial role programmatic plays in supporting our ad-funded, open web.”

It will be interesting to see the effects of this report on the ad-tech ecosystem. The industry’s Wild West days have been waning for quite some time, as funding dries up, consolidation speeds up, regulations force companies to close up and the elimination of cookies will make everyone clean up.

Over the last several years, VC funding for ad-tech companies has dropped. According to TechCruch, “deal flow has fallen at a roughly 10% compounded annual growth rate over the last five years.” And of course there will be outliers, but the investment community pumping the brakes on ad tech firms is a signal.

And as data and privacy regulations sweep the industry—from GDPR to CCPA, and what’s yet to come—ad-tech shops have been forced to reassess their business, leading some to even close their doors in regulation-heavy areas. For example, Verve and Drawbridge each shuttered their European offices after GDPR was implemented.

So funding dries up, regulations force ad-tech firms to take a hard look in the mirror, and then comes Google saying, “You know what would be fun? We’re going to stop letting third-party ad targeting on Chrome.”

Oh, and for good measure, let’s throw in the current global pandemic. Adweek reports that, perhaps unsurprisingly, the coronavirus has had an impact on ad tech. The ad-tech community, for example, has petitioned Google to put its cookie-less world on hold due to the coronavirus. Though that is not likely.

You take these signals and it’s not hard to think that ad tech is in trouble. The questions, of course, are: so what? And, what’s next?

If history is any indication, ad tech will find new land to plunder. Take connected TV (CTV) and OTT.

Today, for example, Kevin Arrix, head of sales for DISH told AdExchanger, “Advertisers are going to use data and technology to make sure the dollars they spend are driving known and big impacts.”

Yesterday, Roku introduced its DSP “OneView Ad Platform,” wrapping its October acquisition of Dataxu into a one-stop-shop.

“Our goal is to help advertisers and content partners invest for a world where all TV is streamed,” Scott Rosenberg, svp and gm, Platform Business at Roku, said in a statement. “OneView provides the data and scale across the entire TV landscape so marketers can plan, buy and measure TV advertising and ultimately shift spend to streaming more quickly.”

Roku is just the latest streaming company to have its own DSP. AT&T, for example, brought Xandr into the WarnerMedia mix last week, consolidating ad sales units. And Verizon yesterday joined the TV advertising consortium Ampersand, “in a move to attract more brands to buy commercial space on Fios and through its internet ad marketplace,” according to AdAge.

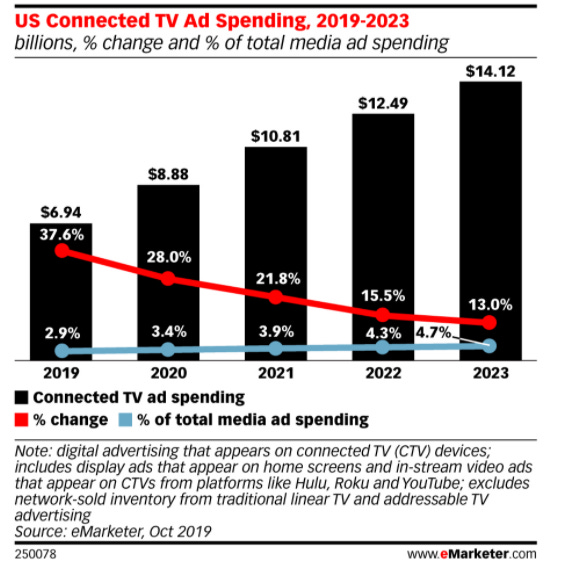

As CTV becomes a more important aspect of the digital, if not linear, ecosystem, watch for today’s ad-tech companies to follow the money. eMarketer, for instance, pegs the CTV industry to be a $14 billion industry by the end of 2023.

They’ve been doing that for decades, going from ad networks to ad exchanges to DSPs/SSPs. Old wine, new bottle.

It’ll be up to the industry to not repeat the sins of the past. With more transparency, and reports like the ISBAs, perhaps the system can be fixed.

Pink Floyd, “Money”

Some interesting links for today:

Disneyland in China set to reopen May 11. Though with curious social distancing queues. (Gizmodo)

AirBnB’s CEO shows how empathy is one of the strongest characteristics of leadership. (AirBnB)

In Q1 earnings, the New York Times says it had 587k net new digital subscribers. (NYT)

A problem I don’t have, but many do: How to handle a micromanager when working from home. (CNN)

I had the honor of being a guest on the What Happens in Ad Tech podcast. Check it out. (YouTube)

Thank you for allowing me in your inbox; thank you for reading. If you have any tips or thoughts about this newsletter, drop me a line!