Hello and happy Monday. Welcome to the first edition of The Media Spy. After a brain fart on Friday afternoon to start this newsletter, 340 very good and smart people signed up. Amazing! I am humbled and grateful. Thank you.

The coronavirus has exposed the frailty of the media business. Not like we didn’t know the media industry was volatile, but now we're watching, in real time, how an industry built on a house of cards is collapsing.

Over the last decade, media companies engaged in a race for scale. Get those clicks; get those pageviews; get that ad revenue. The metrics for digital media were always suspect. And now, when advertising budgets are scrapped and events are canceled, many of these digital darlings face an existential crisis.

Take Vice, for example. A year ago, one of the company’s biggest investors, Disney, which dumped more than $400 million into the media company, said that it doesn’t think it will ever see a return on its investment. And that came on the heels of Vice raising $250 million in debt, not including the $450 injection it got from TPG in 2017.

As the WSJ reported in February, Vice’s investors are knocking at the door for some money, playing out one of my favorite scenes in Goodfellas: “Business is bad? Fuck you, pay me.”

And now that coronavirus has caused marketers to pull budgets, what happens to a media company where half of its revenue reportedly comes through its agency, and of which is mostly project work?

And then there’s the poster child for new media, BuzzFeed. According to a Saturday Business Insider piece, while the company is poised to lose $20 million, “This challenging period could prove to be the ultimate test for [BuzzFeed CEO Jonah] Peretti as both an entrepreneur and a leader.”

The company raised $200 million from NBCUniversal in 2015 after showing the industry how sponsored content can work. However, that shiny veneer stripped away as the outlet couldn’t continue to show buyers value.

As one buyer talking anonymously as they weren’t permitted to speak publicly told me recently, “The numbers of engagement aren’t through the roof, so it’s hard to make the case to consider them because there's no real scale.”

Buyers have told me over the years that the outlet isn’t a ‘must-buy,’ however, there are pockets where a buyer will throw them onto a plan. Namely, dropping some quick bids programmatically to spend some client cash on the one hand, and on the other, put money into Tasty, the company’s food powerhouse, as it’s shown to pop with its audience.

The programmatic play for BuzzFeed was a curious one, as during the early parts of its life, execs swore up and down that it would never get into programmatic.

“They were forced to change with the times,” the buyer said. “It’s the only way to scale what it is you’re doing. If I were BuzzFeed, I’d use the phrase: if we don’t change, we’ll die.”

And this was before the coronavirus caused the company to implement cost-saving measures, like pay cuts.

Over the last few weeks media companies have wrestled with the publisher’s paradox: seeing record traffic numbers but not able to monetize those eyeballs. This has highlighted how the race to scale, the idea that more traffic is better, has been an empty promise. The second part of this equation cannot be lost, either: pumping more content does not increase pageviews or ad impressions.

Of course, digital companies aren’t the only ones grappling with how to navigate these weird times. In today’s New York Times, Conde Nast gets the spotlight, with the nut:

Paris, rather than becoming a moment when Ms. Wintour saved her two treasured industries — magazines and fashion — now looks a bit more like the last stand for her leadership style, for a personal brand larger than her company’s, and for Condé Nast’s long, legendary 20th century. The crisis is set to sweep aside the vestiges of a more luxuriant media age.

(Make sure you read the story, as you’ll learn how my dream of running this newsletter from the south of France is still possible!)

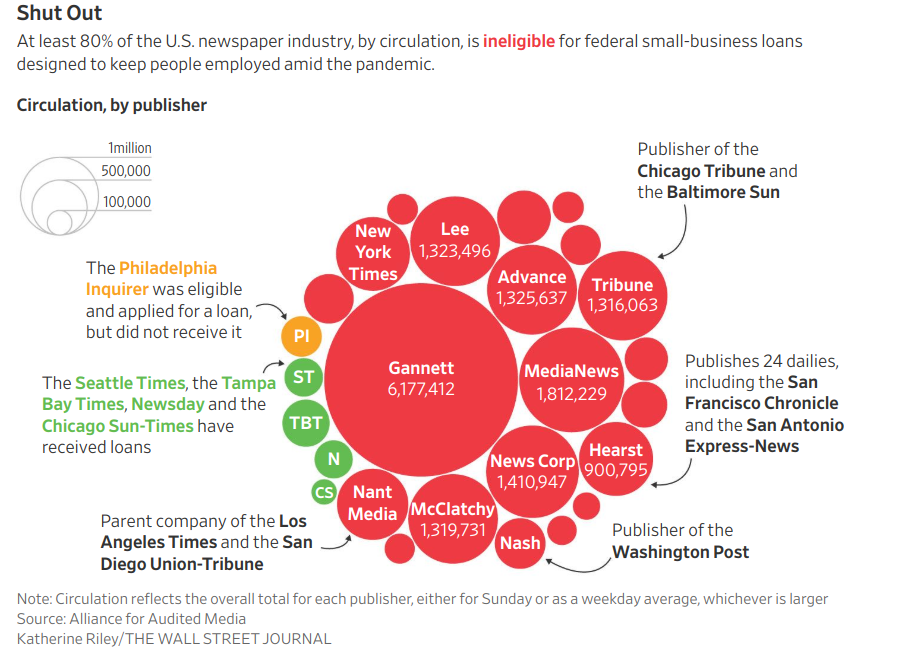

And many newspapers are finding that they are not eligible for the coronavirus stimulus. The WSJ reports today that “Papers representing more than 80% of U.S. circulation are disqualified from the government’s Paycheck Protection Program because of the way their companies are structured, according to data from the Alliance for Audited Media.”

(Image credit: Katherine Riley/The Wall Street Journal)

And as these newspapers, which have also seen traffic skyrocket in recent weeks, have been hit hard because their advertising base, local businesses, have themselves closed or cut back.

(Obligatory ‘duopoly’ mention here: 87 cents of every digital advertising dollar goes to Facebook and Google.)

The coronavirus ravishes through the media landscape, whether a legacy company or a digital darling, as an equalizer. No one is immune. Thousands are losing their jobs; not just reporters, but marketers, sales, biz dev, ad ops. Everyone.

But the media companies that can provide value —to both reader and advertiser—will find a way to survive. Now is the time for publishers to behave responsibly, act with integrity and compassion, and be patient with staff. The next two quarters are going to be as rough a six months as we’ve seen. Let your reporters do journalism; let your sales team be creative.

Guide with a smart hand, and as Eric Idle sings: Always look on the bright side of life.

If you have any thoughts on the newsletter, I’d love to hear them. Drop me a line!

Thank you for reading.

Josh

Well done sir. Looking forward to seeing more from you here.

Great job buddy! Put a smile on my face this morning... xxxxxxxx